Inflate Or Die!

通貨膨脹或死亡!

June 3, 2021 Dennis Miller

Pundit Bill Bonner’s article, “Money-Printing Means Inflation for the U.S. Economy”, concludes:

權威人士比爾·邦納 (Bill Bonner) 的文章“印鈔對美國經濟意味著通貨膨脹”得出結論:

“It’s inflate or die.

就是通貨膨脹或死亡!

And if anyone gets in the way of inflation… the ‘active shooters’ – in both the private sector and the public sector – start gunning for them.

如果有人妨礙通貨膨脹……私營部門和公共部門的“積極射手”就會開始為他們開槍。

Last week, Treasury Secretary Janet Yellen came under fire for saying she might have to raise interest rates.

上週,財政部長珍妮特·耶倫 (Janet Yellen) 因表示她可能不得不提高利率而受到抨擊。

…. There is no real chance that the Biden team will let deficits stand in the way. They’re just going to rename them ‘investments.’

……拜登團隊不會讓赤字成為阻礙。他們只是將它們重命名為“投資”。

…. Even Joe Biden is likely to get the message: Deficits are a good thing.

……甚至喬拜登也可能得到這樣的信息:赤字是一件好事。

The flagging economy will need ‘fiscal stimulus,’ the experts will say.

專家們會說,萎靡不振的經濟將需要“財政刺激”。

And that means money-printing.

這意味著印鈔。

And money-printing means inflation.”

而,印鈔意味著通貨膨脹。”

Pick your poison!

你自己選邊站!

Treasury Secretary and former Fed Chair Janet Yellen mentioned raising interest rates to address inflation. Mr. Bonner pointed out the “active shooters” quickly arrived, and the market reacted negatively.

財政部長和前美聯儲主席珍妮特耶倫提到提高利率以解決通脹問題。邦納先生指出,“活躍的射手”很快就到了,市場反應消極。

Remember when Fed Chairman Ben Bernanke mentioned the Fed might “taper” bond buying? Reuters reported about, The markets and Bernanke’s ‘taper tantrums’. Any hint of the Fed reducing stimulus money for the banks is immediately attacked.

還記得美聯儲主席本·伯南克 (Ben Bernanke) 提到美聯儲可能會“縮減”債券購買嗎?路透社報導了市場和伯南克的“縮減暴怒 (taper tantrums)**”。任何有關美聯儲減少對銀行刺激資金的暗示都會立即遭到抨擊。

**小編註:

“縮減暴怒” Taper tantrum 是指 2013 年引髮美國國債收益率飆升的集體反動恐慌,此前投資者得知美聯儲正在緩慢暫停其量化寬鬆 (QE) 計劃。

When former Fed Chairman Paul Volcker raised interest rates to head off runaway inflation, the market suffered badly until things came under control.

當前美聯儲主席保羅沃爾克提高利率以阻止失控的通貨膨脹時,市場遭受了嚴重的損失,直到事情得到控制。

Today’s market is a Fed-induced, all-time high bubble, waiting to explode. For over a decade, Congress and the Fed used real and imaginary threats to flood the system with trillions of questionable dollars in stimulus packages.

今天的市場是美聯儲引發的歷史最高泡沫,等待爆發。十多年來,國會和美聯儲使用真實和想像的威脅向系統注入數万億美元的可疑經濟刺激計劃。

The Fed knows the investor class won’t stand for even a normal correction.

The Fed sits by and does nothing to hold down inflation.

The Bureau of Labor statistics creates phony data.

The political class pretends all is well. Potential political appointees who might encourage government fiscal discipline are quickly dismissed.

Meanwhile, prices are soaring through the roof, the consumer knows it and soon there will be pressure on Congress to “do something.”

美聯儲知道,即使是正常的調整,投資者階層也不會支持。

美聯儲袖手旁觀,沒有採取任何措施可以來抑制通貨膨脹。

勞工統計局創建虛假數據。

政治課假裝一切都好。可能鼓勵政府財政紀律的潛在政治任命人員很快被解僱。

與此同時,價格飛漲,消費者知道這一點,很快國會就會面臨“需要做點什麼!”的壓力。

Does the Fed let the consumer go bankrupt, savers see their nest egg disappear to inflation while the dollar crumbles and prices soar?

Does the Fed corral inflation, let the investor class take a hit, with the inevitable correction that should have been allowed to take place in 2008?

Does congress allow interest rates to rise, adding billions in annual interest cost to their current spending binge?

…or do they do nothing?

美聯儲是否讓消費者破產,儲戶眼睜睜地看著他們的儲備金因通貨膨脹而消失,而美元崩潰和物價飆升?

美聯儲是否會抑制通脹,讓投資者階層受到打擊,並在 2008 年發生本應允許的不可避免的調整?

國會是否允許利率上升,在他們目前的消費狂潮中增加數十億美元的年度利息成本?

……或者他們什麼都不做?

The Volcker Years

前美聯儲主席沃爾克時代

The Balance offers some great insight into former Fed Chairman(1979-1987) Paul Volcker and his legendary battle to bring down inflation:

《天平》對前美聯儲主席(1979-1987)保羅沃爾克及其為降低通脹而進行的傳奇鬥爭提供了一些深刻的見解:

“Volcker knew he must take dramatic and consistent action for everyone to believe he could tame inflation. President Nixon had contributed to inflation by ending the gold standard in 1973. The dollar’s value plummeted on the foreign exchange markets. That made import prices higher, creating inflation.

“沃爾克知道他必須採取戲劇性和一致的行動,讓每個人都相信他可以控制通貨膨脹。尼克森總統於 1973 年結束金本位制,助長了通貨膨脹。美元在外匯市場上的價值暴跌。這導致進口價格上漲,造成通貨膨脹。

.jpg)

Volcker fought greater than 10% annual inflation rates with contractionary monetary policy and courageously raised the fed funds rate to 20% in March 1980. He briefly lowered it in June. When inflation returned, Volcker raised the rate back to 20% in December and kept it above 16% until May 1981. That extreme and prolonged interest rate rise was called the Volcker Shock. It did end inflation. Unfortunately, it also created the 1981 recession.”

沃爾克通過緊縮性貨幣政策對抗超過 10% 的年通脹率,並在 1980 年 3 月勇敢地將聯邦基金利率提高到 20%。他在 6 月短暫降低了利率。當通貨膨脹恢復時,沃爾克在 12 月將利率提高到 20%,並保持在 16% 以上,直到 1981 年 5 月。這種極端和長期的利率上升被稱為沃爾克衝擊。它確實結束了通貨膨脹。不幸的是,它也造成了 1981 年的經濟衰退。”

.jpg)

Many feel Volcker was deeply concerned about hyperinflation. With the USD no longer backed by gold, he raised interest rates to make the USD attractive to the rest of the world.

許多人認為沃爾克對惡性通貨膨脹深表擔憂。由於美元不再受黃金支持,他提高了利率以使美元對世界其他地區具有吸引力。

Changes since the Volcker years

自沃爾克時代以來的變化

I remember those tough times well. Citizens were up in arms. Prices skyrocketed! Taxpayers moved to higher brackets when their real buying power did not increase. A law was finally passed adjusting tax brackets for inflation.

我清楚地記得那些艱難的時期。市民們紛紛起身。價格飛漲!當納稅人的實際購買力沒有增加時,他們會轉移到更高的等級。最終通過了一項針對通貨膨脹調整稅級的法律。

Inflation riders were also added to Social security and other government promises, theoretically allowing pensioners to help keep up with soaring prices.

通貨膨脹附加條款也被添加到社會保障和其他政府承諾中,理論上允許養老金領取者幫助跟上飆升的價格。

Soon the Bureau of Labor Statistics was encouraged to change its method of calculating inflation, for the benefit of the government.

很快,為了政府的利益,勞工統計局被鼓勵改變其計算通貨膨脹的方法。

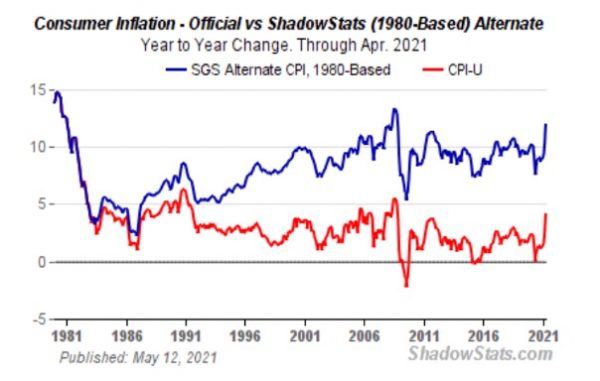

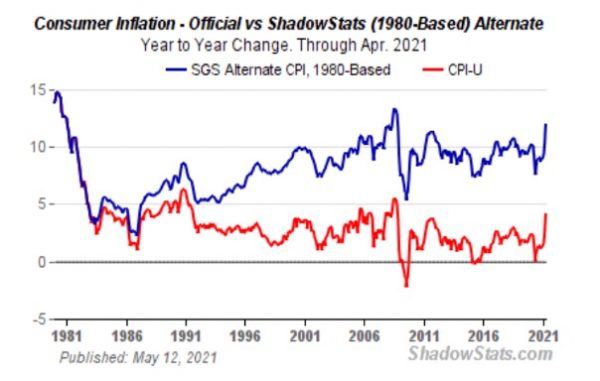

John Williams at Shadowstats provides us with a graph, calculating inflation in the same manner it was during Volcker’s tenure at the Fed.

約翰威廉姆斯的Shadowstats* 為我們提供了一個圖表,以與沃爾克在美聯儲任職期間相同的方式計算通貨膨脹。

**小編註:

John Williams at Shadowstats.com

由獨立經濟學者創立的 “暗黑政府統計數據”,藉由政府所公佈的數據從新計算調整所算出的真實統計數據

If the government did not gerrymander the calculations, our current inflation numbers would be quite close to the numbers Volcker was faced with in 1975.

如果政府沒有對計算進行分類,我們目前的通脹數字將與沃爾克在 1975 年面臨的數字非常接近。

As we recently reported in an interview with international expert, Urs Vrijhof-Droese:

正如我們最近在接受國際專家 Urs Vrijhof-Droese 採訪時報導的那樣:

“The huge stimulus packages, with the possibility of more to come, raises concern about the ability of the USA to cover their debt …. The high debt will negatively impact economic growth in the US.

“龐大的刺激計劃,可能還會有更多刺激計劃,這引起了人們對美國償還債務能力的擔憂……。高債務將對美國的經濟增長產生負面影響。

Also, Asia and Russia have a problem with the USD being the global reserve currency. According to the WSJ, the USD’s share of global reserve moved to its lowest level since 1995….”

此外,亞洲和俄羅斯也存在美元作為全球儲備貨幣的問題。據《華爾街日報》報導,美元在全球儲備中的份額跌至 1995 年以來的最低水平……”

What would Volcker see today? Inflation sharply jumped to double digits, the world is losing interest in the USD as a reserve currency, and we need to find ways to stop inflation quickly or it will spiral out of control.

沃爾克今天會看到什麼?通貨膨脹率飆升至兩位數,世界對美元作為儲備貨幣失去興趣,我們需要找到快速阻止通貨膨脹的方法,否則它會失控。

The biggie no one wants to mention!

沒人想提的大佬!

The Federal Reserve is owned by the big banks, just like it was during the Volcker years. However, one major thing has changed.

美聯儲由大銀行所擁有,就像在沃爾克時代一樣。然而,一件重要的事情發生了變化。

During Volcker’s tenure, the banks’ primary source of income was from the banking business. They accepted customer deposits and borrowed money by issuing CDs and other debt instruments – paying interest for the use of their capital. Banks would lend those funds and more (due to fractional banking rules) at higher interest rates; they made their money on the spread.

在沃爾克任職期間,銀行的主要收入來源是銀行業務。他們通過發行CD和其他債務工具接受客戶存款並藉入資金——為使用他們的資本支付利息。銀行將以更高的利率借出這些資金以及更多(由於部分銀行規則);他們靠點差賺錢。

註: CD (collateralized debt債務擔保)

When Volcker raised rates, while it cost the banks more for their capital, they also raised rates for their loans.

當沃爾克提高利率時,雖然銀行的資本成本更高,但他們也提高了貸款利率。

Chuck Butler, a real banking expert, says the normal spread was around 5%. In times of rapidly raising rates, banks would do several things to increase the spread. They would raise loan rates faster than interest rates paid to attract their working capital. When rates reversed, they quickly dropped interest paid for capital, while holding loan rates high. They expertly “gamed” the system to maximize profits.

真正的銀行業專家查克巴特勒表示,正常的利差約為 5%。在快速加息的時候,銀行會做一些事情來增加利差。他們提高貸款利率的速度會快於為吸引營運資金而支付的利率。當利率逆轉時,他們迅速降低了為資本支付的利息,同時將貸款利率保持在高位。他們熟練地“玩弄”系統以最大化利潤。

Bankers knew rates would eventually come down and borrowers would refinance at lower rates as soon as they could. They charged preposterous “loan origination fees” and other upfront loan costs to increase their profits. If you sold your home, you were likely required to pay “points” toward the buyer’s mortgage origination fees.

銀行家們知道利率最終會下降,借款人會盡快以較低的利率再融資。他們收取荒謬的“貸款發起費”和其他前期貸款成本以增加利潤。如果你賣掉了你的房子,你可能需要為買家的抵押貸款發起費用支付“積分”。

My parents saw the buying power of their nest egg drop dramatically. With three teenagers in the house, our living costs skyrocketed. Living through those challenging times leaves a mark.

我的父母看到他們的 “窩蛋**“ 的購買力急劇下降。家裡有三個青少年,我們的生活成本飛漲。度過那些充滿挑戰的時代會留下印記。

註:

“窩蛋 Nest Egg” 意旨

儲備金是為特定目的而儲蓄或投資的大量金錢或其他資產。此類資產通常用於長期目標,最常見的是退休、購房和教育。

The biggie? Mr. Volcker’s management (big banks) would not be severely hurt and could rake in more profit when he increased rates to make the USD more attractive to the world.

大佬?沃爾克先生的管理層(大銀行)不會受到嚴重傷害,當他提高利率以使美元對世界更具吸引力時,他可以賺取更多利潤。

In 1933 the Glass-Steagall Act was passed to protect the public. Banks were required to hold ample reserves and their loan portfolios were regularly audited. High-risk loans and investment operations were not allowed by FDIC-insured banks. Interstate banking was not allowed, no bank should ever be “too big to fail”.

1933 年通過了《格拉斯-斯蒂格爾法案》以保護公眾。銀行必須持有充足的準備金,並定期審計其貸款組合。 FDIC 承保的銀行不允許進行高風險貸款和投資操作。不允許州際銀行業務,任何銀行都不應該“大到不能倒”。

When the law was repealed in 1999, we saw a flurry of bank mergers and acquisitions; the big banks gobbled up thousands of smaller banks. Big brokerage firms also merged with banks into what we now call “casino banks.”

1999 年該法被廢除時,我們看到了銀行併購的狂潮;大銀行吞併了數千家小銀行。大型經紀公司也與銀行合併,成為我們現在所說的“賭場銀行”。

The major banks that own the Federal Reserve are no longer in the banking business as we once knew it!

擁有美聯儲的主要銀行不再像我們曾經知道的那樣從事銀行業務!

Today their primary profits come from investment and brokerage operations. The top banks control much of the wealth of the nation, earning fees from investors. Their high-risk derivative exposure is in the trillions – all under the FDIC umbrella.

今天,他們的主要利潤來自投資和經紀業務。頂級銀行控制著國家的大部分財富,從投資者那裡賺取費用。他們的高風險衍生品敞口高達數万億——都在 FDIC 的保護傘下。

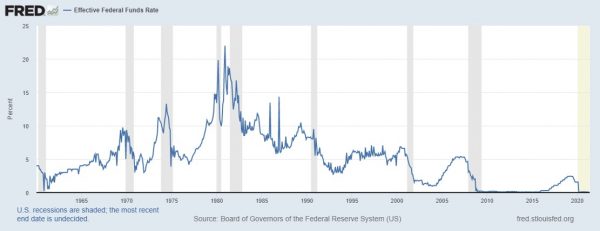

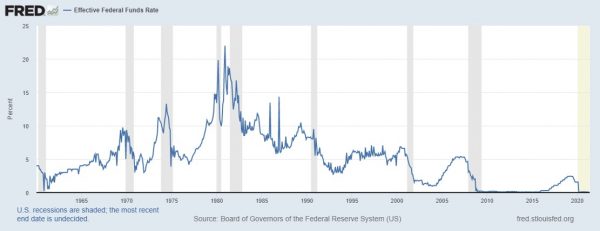

Note the sharp drop in the Fed funds rate shortly after Glass-Steagall was repealed in 1999. Who benefits the most from that? The banking system and government; the largest debtor in world history.

請注意在 1999 年格拉斯-斯蒂格爾法案被廢除後不久聯邦基金利率急劇下降。誰從中受益最大?銀行系統和政府;世界歷史上最大的債務人。

Had the government not dropped interest rates to historic lows in 2008, savers, pension funds and 401ks would be worth trillions more today.

如果政府沒有在 2008 年將利率降至歷史低點,那麼今天的儲蓄者、養老基金和 401ks 的價值將增加數万億美元。

Let’s not kid ourselves!

我們不要自欺欺人!

Expecting another Paul Volcker to appear is foolhardy. The Fed ownership and government would not allow it. Raising interest rates will cost the government billions in additional interest and the casino banks even more in lost revenue.

期待另一個保羅沃爾克出現是魯莽的。美聯儲的所有權和政府不會允許它。提高利率將使政府損失數十億美元的額外利息,賭場銀行的收入損失更大。

One change since the Volcker years is the ability of government officials to “jawbone” the world into believing that changes are taking place. Janet Yellen mentions the possibility of raising rates, (from maybe .25% to .5%) and we see a hissy fit. As Mr. Bonner said, the “active shooters” in the public and private sector start gunning for them; and the comments are quickly backtracked.

自沃爾克時代以來的一個變化是,政府官員有能力讓世界相信變化正在發生。珍妮特·耶倫提到了加息的可能性(從 0.25% 到 0.5%),我們認為這很合適。正如邦納先生所說,公共和私營部門的“活躍射手”開始為他們開槍;並且評論很快被退回。

My first thought when reading Bonner’s headline, “Inflate or die” was likely one he didn’t anticipate. When he added, “active shooters” I stopped – “Is this a double meaning?” If I were the current Fed head, I would be leery of any new people assigned to my security detail. The big boys have much to lose if the Fed raises rates.

在閱讀邦納的標題時,我的第一個想法可能是他沒有預料到的“通貨膨脹或死亡”。當他補充說“主動射手”時,我停了下來——“這是雙重含義嗎?”如果我是現任美聯儲主席,我會對分配給我的安全細節的任何新人持懷疑態度。如果美聯儲加息,大佬們會失去很多。

What can we do?

我們能夠做些什麼?

Golden rectangle with check markThis George Bernard Shaw quotes sums it up well:

帶有復選標記的金色框框 蕭伯納引用的這個總結得很好:

“You have to choose between trusting to the natural stability of gold and the natural stability and intelligence of the members of the government. And with due respect to these gentlemen, I advise you, as long as the capitalist system lasts, to vote for gold.”

“你必須在 “信任黃金的自然穩定性” 和 “政府成員的自然穩定性” 的智慧之間做出選擇。出於對這些先生們的尊重,我建議你們,只要資本主義制度還在,就投票給黃金。”

Gold and metals stocks outpaced inflation during the Carter years and is likely to do so again. Gold has stood the test of time!

在總統卡特年間,黃金和金屬股的通脹率超過了通脹率,而且很可能會再次如此。因為黃金曾經經歷過了時間的考驗!

Dennis Miller

Shiny黃金白銀交易所

引用: Miller On The Money

通貨膨脹或死亡!

June 3, 2021 Dennis Miller

Pundit Bill Bonner’s article, “Money-Printing Means Inflation for the U.S. Economy”, concludes:

權威人士比爾·邦納 (Bill Bonner) 的文章“印鈔對美國經濟意味著通貨膨脹”得出結論:

“It’s inflate or die.

就是通貨膨脹或死亡!

And if anyone gets in the way of inflation… the ‘active shooters’ – in both the private sector and the public sector – start gunning for them.

如果有人妨礙通貨膨脹……私營部門和公共部門的“積極射手”就會開始為他們開槍。

Last week, Treasury Secretary Janet Yellen came under fire for saying she might have to raise interest rates.

上週,財政部長珍妮特·耶倫 (Janet Yellen) 因表示她可能不得不提高利率而受到抨擊。

…. There is no real chance that the Biden team will let deficits stand in the way. They’re just going to rename them ‘investments.’

……拜登團隊不會讓赤字成為阻礙。他們只是將它們重命名為“投資”。

…. Even Joe Biden is likely to get the message: Deficits are a good thing.

……甚至喬拜登也可能得到這樣的信息:赤字是一件好事。

The flagging economy will need ‘fiscal stimulus,’ the experts will say.

專家們會說,萎靡不振的經濟將需要“財政刺激”。

And that means money-printing.

這意味著印鈔。

And money-printing means inflation.”

而,印鈔意味著通貨膨脹。”

Pick your poison!

你自己選邊站!

Treasury Secretary and former Fed Chair Janet Yellen mentioned raising interest rates to address inflation. Mr. Bonner pointed out the “active shooters” quickly arrived, and the market reacted negatively.

財政部長和前美聯儲主席珍妮特耶倫提到提高利率以解決通脹問題。邦納先生指出,“活躍的射手”很快就到了,市場反應消極。

Remember when Fed Chairman Ben Bernanke mentioned the Fed might “taper” bond buying? Reuters reported about, The markets and Bernanke’s ‘taper tantrums’. Any hint of the Fed reducing stimulus money for the banks is immediately attacked.

還記得美聯儲主席本·伯南克 (Ben Bernanke) 提到美聯儲可能會“縮減”債券購買嗎?路透社報導了市場和伯南克的“縮減暴怒 (taper tantrums)**”。任何有關美聯儲減少對銀行刺激資金的暗示都會立即遭到抨擊。

**小編註:

“縮減暴怒” Taper tantrum 是指 2013 年引髮美國國債收益率飆升的集體反動恐慌,此前投資者得知美聯儲正在緩慢暫停其量化寬鬆 (QE) 計劃。

When former Fed Chairman Paul Volcker raised interest rates to head off runaway inflation, the market suffered badly until things came under control.

當前美聯儲主席保羅沃爾克提高利率以阻止失控的通貨膨脹時,市場遭受了嚴重的損失,直到事情得到控制。

Today’s market is a Fed-induced, all-time high bubble, waiting to explode. For over a decade, Congress and the Fed used real and imaginary threats to flood the system with trillions of questionable dollars in stimulus packages.

今天的市場是美聯儲引發的歷史最高泡沫,等待爆發。十多年來,國會和美聯儲使用真實和想像的威脅向系統注入數万億美元的可疑經濟刺激計劃。

The Fed knows the investor class won’t stand for even a normal correction.

The Fed sits by and does nothing to hold down inflation.

The Bureau of Labor statistics creates phony data.

The political class pretends all is well. Potential political appointees who might encourage government fiscal discipline are quickly dismissed.

Meanwhile, prices are soaring through the roof, the consumer knows it and soon there will be pressure on Congress to “do something.”

美聯儲知道,即使是正常的調整,投資者階層也不會支持。

美聯儲袖手旁觀,沒有採取任何措施可以來抑制通貨膨脹。

勞工統計局創建虛假數據。

政治課假裝一切都好。可能鼓勵政府財政紀律的潛在政治任命人員很快被解僱。

與此同時,價格飛漲,消費者知道這一點,很快國會就會面臨“需要做點什麼!”的壓力。

Does the Fed let the consumer go bankrupt, savers see their nest egg disappear to inflation while the dollar crumbles and prices soar?

Does the Fed corral inflation, let the investor class take a hit, with the inevitable correction that should have been allowed to take place in 2008?

Does congress allow interest rates to rise, adding billions in annual interest cost to their current spending binge?

…or do they do nothing?

美聯儲是否讓消費者破產,儲戶眼睜睜地看著他們的儲備金因通貨膨脹而消失,而美元崩潰和物價飆升?

美聯儲是否會抑制通脹,讓投資者階層受到打擊,並在 2008 年發生本應允許的不可避免的調整?

國會是否允許利率上升,在他們目前的消費狂潮中增加數十億美元的年度利息成本?

……或者他們什麼都不做?

The Volcker Years

前美聯儲主席沃爾克時代

The Balance offers some great insight into former Fed Chairman(1979-1987) Paul Volcker and his legendary battle to bring down inflation:

《天平》對前美聯儲主席(1979-1987)保羅沃爾克及其為降低通脹而進行的傳奇鬥爭提供了一些深刻的見解:

“Volcker knew he must take dramatic and consistent action for everyone to believe he could tame inflation. President Nixon had contributed to inflation by ending the gold standard in 1973. The dollar’s value plummeted on the foreign exchange markets. That made import prices higher, creating inflation.

“沃爾克知道他必須採取戲劇性和一致的行動,讓每個人都相信他可以控制通貨膨脹。尼克森總統於 1973 年結束金本位制,助長了通貨膨脹。美元在外匯市場上的價值暴跌。這導致進口價格上漲,造成通貨膨脹。

.jpg)

Volcker fought greater than 10% annual inflation rates with contractionary monetary policy and courageously raised the fed funds rate to 20% in March 1980. He briefly lowered it in June. When inflation returned, Volcker raised the rate back to 20% in December and kept it above 16% until May 1981. That extreme and prolonged interest rate rise was called the Volcker Shock. It did end inflation. Unfortunately, it also created the 1981 recession.”

沃爾克通過緊縮性貨幣政策對抗超過 10% 的年通脹率,並在 1980 年 3 月勇敢地將聯邦基金利率提高到 20%。他在 6 月短暫降低了利率。當通貨膨脹恢復時,沃爾克在 12 月將利率提高到 20%,並保持在 16% 以上,直到 1981 年 5 月。這種極端和長期的利率上升被稱為沃爾克衝擊。它確實結束了通貨膨脹。不幸的是,它也造成了 1981 年的經濟衰退。”

.jpg)

Many feel Volcker was deeply concerned about hyperinflation. With the USD no longer backed by gold, he raised interest rates to make the USD attractive to the rest of the world.

許多人認為沃爾克對惡性通貨膨脹深表擔憂。由於美元不再受黃金支持,他提高了利率以使美元對世界其他地區具有吸引力。

Changes since the Volcker years

自沃爾克時代以來的變化

I remember those tough times well. Citizens were up in arms. Prices skyrocketed! Taxpayers moved to higher brackets when their real buying power did not increase. A law was finally passed adjusting tax brackets for inflation.

我清楚地記得那些艱難的時期。市民們紛紛起身。價格飛漲!當納稅人的實際購買力沒有增加時,他們會轉移到更高的等級。最終通過了一項針對通貨膨脹調整稅級的法律。

Inflation riders were also added to Social security and other government promises, theoretically allowing pensioners to help keep up with soaring prices.

通貨膨脹附加條款也被添加到社會保障和其他政府承諾中,理論上允許養老金領取者幫助跟上飆升的價格。

Soon the Bureau of Labor Statistics was encouraged to change its method of calculating inflation, for the benefit of the government.

很快,為了政府的利益,勞工統計局被鼓勵改變其計算通貨膨脹的方法。

John Williams at Shadowstats provides us with a graph, calculating inflation in the same manner it was during Volcker’s tenure at the Fed.

約翰威廉姆斯的Shadowstats* 為我們提供了一個圖表,以與沃爾克在美聯儲任職期間相同的方式計算通貨膨脹。

**小編註:

John Williams at Shadowstats.com

由獨立經濟學者創立的 “暗黑政府統計數據”,藉由政府所公佈的數據從新計算調整所算出的真實統計數據

If the government did not gerrymander the calculations, our current inflation numbers would be quite close to the numbers Volcker was faced with in 1975.

如果政府沒有對計算進行分類,我們目前的通脹數字將與沃爾克在 1975 年面臨的數字非常接近。

As we recently reported in an interview with international expert, Urs Vrijhof-Droese:

正如我們最近在接受國際專家 Urs Vrijhof-Droese 採訪時報導的那樣:

“The huge stimulus packages, with the possibility of more to come, raises concern about the ability of the USA to cover their debt …. The high debt will negatively impact economic growth in the US.

“龐大的刺激計劃,可能還會有更多刺激計劃,這引起了人們對美國償還債務能力的擔憂……。高債務將對美國的經濟增長產生負面影響。

Also, Asia and Russia have a problem with the USD being the global reserve currency. According to the WSJ, the USD’s share of global reserve moved to its lowest level since 1995….”

此外,亞洲和俄羅斯也存在美元作為全球儲備貨幣的問題。據《華爾街日報》報導,美元在全球儲備中的份額跌至 1995 年以來的最低水平……”

What would Volcker see today? Inflation sharply jumped to double digits, the world is losing interest in the USD as a reserve currency, and we need to find ways to stop inflation quickly or it will spiral out of control.

沃爾克今天會看到什麼?通貨膨脹率飆升至兩位數,世界對美元作為儲備貨幣失去興趣,我們需要找到快速阻止通貨膨脹的方法,否則它會失控。

The biggie no one wants to mention!

沒人想提的大佬!

The Federal Reserve is owned by the big banks, just like it was during the Volcker years. However, one major thing has changed.

美聯儲由大銀行所擁有,就像在沃爾克時代一樣。然而,一件重要的事情發生了變化。

During Volcker’s tenure, the banks’ primary source of income was from the banking business. They accepted customer deposits and borrowed money by issuing CDs and other debt instruments – paying interest for the use of their capital. Banks would lend those funds and more (due to fractional banking rules) at higher interest rates; they made their money on the spread.

在沃爾克任職期間,銀行的主要收入來源是銀行業務。他們通過發行CD和其他債務工具接受客戶存款並藉入資金——為使用他們的資本支付利息。銀行將以更高的利率借出這些資金以及更多(由於部分銀行規則);他們靠點差賺錢。

註: CD (collateralized debt債務擔保)

When Volcker raised rates, while it cost the banks more for their capital, they also raised rates for their loans.

當沃爾克提高利率時,雖然銀行的資本成本更高,但他們也提高了貸款利率。

Chuck Butler, a real banking expert, says the normal spread was around 5%. In times of rapidly raising rates, banks would do several things to increase the spread. They would raise loan rates faster than interest rates paid to attract their working capital. When rates reversed, they quickly dropped interest paid for capital, while holding loan rates high. They expertly “gamed” the system to maximize profits.

真正的銀行業專家查克巴特勒表示,正常的利差約為 5%。在快速加息的時候,銀行會做一些事情來增加利差。他們提高貸款利率的速度會快於為吸引營運資金而支付的利率。當利率逆轉時,他們迅速降低了為資本支付的利息,同時將貸款利率保持在高位。他們熟練地“玩弄”系統以最大化利潤。

Bankers knew rates would eventually come down and borrowers would refinance at lower rates as soon as they could. They charged preposterous “loan origination fees” and other upfront loan costs to increase their profits. If you sold your home, you were likely required to pay “points” toward the buyer’s mortgage origination fees.

銀行家們知道利率最終會下降,借款人會盡快以較低的利率再融資。他們收取荒謬的“貸款發起費”和其他前期貸款成本以增加利潤。如果你賣掉了你的房子,你可能需要為買家的抵押貸款發起費用支付“積分”。

My parents saw the buying power of their nest egg drop dramatically. With three teenagers in the house, our living costs skyrocketed. Living through those challenging times leaves a mark.

我的父母看到他們的 “窩蛋**“ 的購買力急劇下降。家裡有三個青少年,我們的生活成本飛漲。度過那些充滿挑戰的時代會留下印記。

註:

“窩蛋 Nest Egg” 意旨

儲備金是為特定目的而儲蓄或投資的大量金錢或其他資產。此類資產通常用於長期目標,最常見的是退休、購房和教育。

The biggie? Mr. Volcker’s management (big banks) would not be severely hurt and could rake in more profit when he increased rates to make the USD more attractive to the world.

大佬?沃爾克先生的管理層(大銀行)不會受到嚴重傷害,當他提高利率以使美元對世界更具吸引力時,他可以賺取更多利潤。

In 1933 the Glass-Steagall Act was passed to protect the public. Banks were required to hold ample reserves and their loan portfolios were regularly audited. High-risk loans and investment operations were not allowed by FDIC-insured banks. Interstate banking was not allowed, no bank should ever be “too big to fail”.

1933 年通過了《格拉斯-斯蒂格爾法案》以保護公眾。銀行必須持有充足的準備金,並定期審計其貸款組合。 FDIC 承保的銀行不允許進行高風險貸款和投資操作。不允許州際銀行業務,任何銀行都不應該“大到不能倒”。

When the law was repealed in 1999, we saw a flurry of bank mergers and acquisitions; the big banks gobbled up thousands of smaller banks. Big brokerage firms also merged with banks into what we now call “casino banks.”

1999 年該法被廢除時,我們看到了銀行併購的狂潮;大銀行吞併了數千家小銀行。大型經紀公司也與銀行合併,成為我們現在所說的“賭場銀行”。

The major banks that own the Federal Reserve are no longer in the banking business as we once knew it!

擁有美聯儲的主要銀行不再像我們曾經知道的那樣從事銀行業務!

Today their primary profits come from investment and brokerage operations. The top banks control much of the wealth of the nation, earning fees from investors. Their high-risk derivative exposure is in the trillions – all under the FDIC umbrella.

今天,他們的主要利潤來自投資和經紀業務。頂級銀行控制著國家的大部分財富,從投資者那裡賺取費用。他們的高風險衍生品敞口高達數万億——都在 FDIC 的保護傘下。

Note the sharp drop in the Fed funds rate shortly after Glass-Steagall was repealed in 1999. Who benefits the most from that? The banking system and government; the largest debtor in world history.

請注意在 1999 年格拉斯-斯蒂格爾法案被廢除後不久聯邦基金利率急劇下降。誰從中受益最大?銀行系統和政府;世界歷史上最大的債務人。

Had the government not dropped interest rates to historic lows in 2008, savers, pension funds and 401ks would be worth trillions more today.

如果政府沒有在 2008 年將利率降至歷史低點,那麼今天的儲蓄者、養老基金和 401ks 的價值將增加數万億美元。

Let’s not kid ourselves!

我們不要自欺欺人!

Expecting another Paul Volcker to appear is foolhardy. The Fed ownership and government would not allow it. Raising interest rates will cost the government billions in additional interest and the casino banks even more in lost revenue.

期待另一個保羅沃爾克出現是魯莽的。美聯儲的所有權和政府不會允許它。提高利率將使政府損失數十億美元的額外利息,賭場銀行的收入損失更大。

One change since the Volcker years is the ability of government officials to “jawbone” the world into believing that changes are taking place. Janet Yellen mentions the possibility of raising rates, (from maybe .25% to .5%) and we see a hissy fit. As Mr. Bonner said, the “active shooters” in the public and private sector start gunning for them; and the comments are quickly backtracked.

自沃爾克時代以來的一個變化是,政府官員有能力讓世界相信變化正在發生。珍妮特·耶倫提到了加息的可能性(從 0.25% 到 0.5%),我們認為這很合適。正如邦納先生所說,公共和私營部門的“活躍射手”開始為他們開槍;並且評論很快被退回。

My first thought when reading Bonner’s headline, “Inflate or die” was likely one he didn’t anticipate. When he added, “active shooters” I stopped – “Is this a double meaning?” If I were the current Fed head, I would be leery of any new people assigned to my security detail. The big boys have much to lose if the Fed raises rates.

在閱讀邦納的標題時,我的第一個想法可能是他沒有預料到的“通貨膨脹或死亡”。當他補充說“主動射手”時,我停了下來——“這是雙重含義嗎?”如果我是現任美聯儲主席,我會對分配給我的安全細節的任何新人持懷疑態度。如果美聯儲加息,大佬們會失去很多。

What can we do?

我們能夠做些什麼?

Golden rectangle with check markThis George Bernard Shaw quotes sums it up well:

帶有復選標記的金色框框 蕭伯納引用的這個總結得很好:

“You have to choose between trusting to the natural stability of gold and the natural stability and intelligence of the members of the government. And with due respect to these gentlemen, I advise you, as long as the capitalist system lasts, to vote for gold.”

“你必須在 “信任黃金的自然穩定性” 和 “政府成員的自然穩定性” 的智慧之間做出選擇。出於對這些先生們的尊重,我建議你們,只要資本主義制度還在,就投票給黃金。”

Gold and metals stocks outpaced inflation during the Carter years and is likely to do so again. Gold has stood the test of time!

在總統卡特年間,黃金和金屬股的通脹率超過了通脹率,而且很可能會再次如此。因為黃金曾經經歷過了時間的考驗!

Dennis Miller

Shiny黃金白銀交易所

引用: Miller On The Money